5 November 2025

Iliana Portugues

A Strategic Playbook for Energy Technology Founders

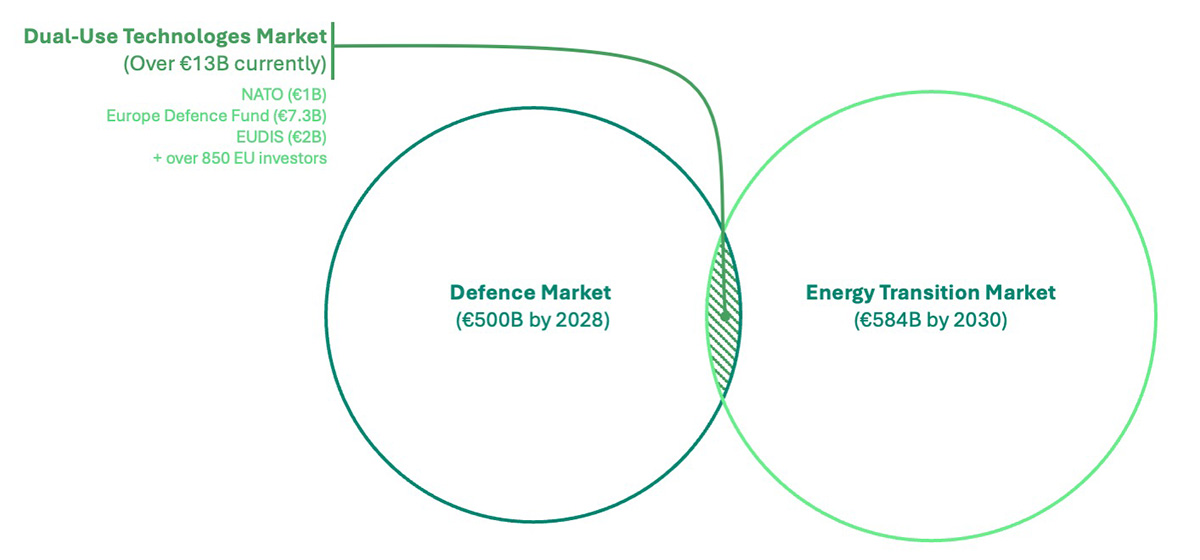

Europe, a pivotal player in the global energy and defence markets, is currently at a historic convergence point. The merging of these sectors presents a unified € 100 billion+ annual opportunity. This unique scenario allows energy technology founders to play a crucial role in both civilian energy transition and military modernisation. By leveraging the same core technology, founders can access unprecedented government support, preferential procurement treatment, and strategic acquisition premiums, thereby shaping the future of the industry.

The numbers are compelling; defence budgets are expected to surge toward €500 billion by 2028. Energy transition requires €584 billion in grid infrastructure by 2030. Dual-use technologies captured €4.9 billion in venture funding during 2024—representing 10% of all European VC investment, an all-time high. The European Defence Fund, a key player in the market, allocates €1.065 billion in 2025 explicitly for energy resilience. The NATO Innovation Fund, another significant contributor, deploys €1 billion across 15 years. Over 850 active investors now target the defence-security-resilience sector.

Description: A Venn diagram showing the intersection of three circles - 'Defence Market (€500B by 2028)', 'Energy Transition (€584B by 2030)', and 'Dual-Use Technologies (€13B+ current)'. The intersection highlights key technology categories (batteries, hydrogen, grid technology, AI/cybersecurity) along with their corresponding funding amounts. Arrows indicate the flow of capital from government programs (EDF, DIANA, EUDIS) and VCs.

The strategic catalyst for this unprecedented convergence is Russia's invasion of Ukraine, which has led to the most significant realignment of industrial policy since the Second World War. The EU's revolutionary 'dual-use by design' doctrine, formalised in 2025, mandates that new technologies serve both civilian energy independence and military capability simultaneously. This creates a unique window of opportunity for founders developing battery systems, hydrogen fuel cells, grid technologies, or energy software. The potential for growth and innovation in this market is immense, inspiring optimism and a sense of purpose among the audience.

Key Market Dynamics at a Glance

Metric | 2024 Actual | 2028 Projected |

DSR VC Funding | €4.9 billion | €12+ billion |

Defense Budgets | €380 billion | €500 billion |

Active Investors | 850+ | 1,500+ |

Immediate action window: €3.2 billion in grants and accelerator programs accept applications between November 2025 and June 2026. The European Defence Fund's 2026 calls open in January with €1.2 billion available. The EUDIS Spring 2026 accelerator will provide € 85,000 per startup. Founders who act within this window can secure non-dilutive funding while building relationships with both civilian and military customers—a combination that typically takes years to develop organically.

Why The Information in This Report Matters To You Now:

Based on analysis of 500+ dual-use startups, €4.9 billion in recent investments, and exclusive insights from NATO DIANA, European Defence Fund, and leading defence VCs, this report provides the definitive playbook for founders entering the dual-use energy sector. It reveals which technologies attract the most funding (battery storage leads with €100+ million rounds), which accelerators provide access to military customers (DIANA's 44% selection-to-contract rate), and exactly how to navigate export controls while maintaining venture scalability.